Having A Baby Is Costly And Confusing -- Even For A Health Policy Expert

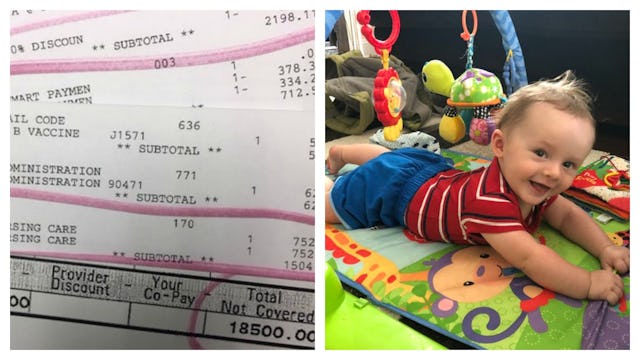

It is hard to believe that it has been just over since five months since our second son, Lukas, was born. His mother, Hollyanne, is doing well, which is something to be thankful for, given the excessive maternal mortality rates in the U.S. Lukas is also healthy and growing, albeit sleeping little at night. What is unbelievable is the fact that I am still receiving bills for his birth.

Of course, I “knew” what was going to happen when we found out that my wife was pregnant. I study health policy for a living, and I have written extensively about the American health care system. Yet for all the reading and writing, experiencing health care in America personally is a rather shocking experience. Keep in mind, our birthing experience was without any complications and we have health insurance.

I cannot imagine how overwhelming the experience must be for someone with fewer resources and less of an understanding about health care in America.

RELATED: Lamaze On The Couch: Your Go-To Guide To Online Birthing Classes

Being pregnant and giving birth: Not what it used to be

From the first doctor’s appointment, we were introduced to what to expect: lots of paperwork and lots of bills. There are of course all the monthly, then biweekly, and then weekly doctor’s visits with the corresponding bills.

In West Virginia, due to the opioid epidemic, most doctors will also insist on a drug screen.

As it turned out, my wife’s doctor ordered copious amounts of blood work and ultrasounds – “outpatient diagnostic services,” totaling thousands of dollars. It is hard to question any of these when all you want is a healthy baby – and your doctor is the only one who knows which tests are necessary.

Like most parents, we also wanted to know whether our baby was going to be healthy. Here is the total amount of the bill for genetic testing sent to our insurance company: US$26,755.

allanswart / Getty

Giving birth to our first son, Nico, had been quite an arduous experience for my wife. She labored for more than 30 hours. Determined not to spend hours in the hospital, my wife practically gave birth this time in the front seat of our car. Ultimately, I was able to throw my wife onto a bed in the maternity ward, and Lukas popped right out.

I joked to my wife: “At least they cannot charge us for delivery.” At the very least, I should file a claim with our insurance company.

I am still not quite sure how wrong I was, because every time I ask for a detailed bill, new items appear while others miraculously disappear.

About $65 an hour, for lodging

Simon Haeder

The delivery room, which we used for all of one minute, cost about $7,000. Room and board for my wife for 48 hours cost just over $3,100. Two Tylenols for my wife: $25. Laboratory work: $1,200.

That does not account for Lukas. Room and board for him was just over $1,500. Various laboratory work charges added another $1,400 or so. The hearing test cost $260.

I tried to keep track of all the medical personnel coming and going, but after a while it all became a blur. The doctor, who was not present at birth, charged $4,200 for delivery and care. Pediatricians stopped by a few times to check on Lukas for $150 per look.

We were not able to take advantage of a tax-favored flexible spending account for most of these expenses, because “being pregnant” does not count as a “life event.” While “giving birth” does count, the added contributions cannot be applied to previous costs associated with the birth.

Bringing the baby home

As demanding as giving birth is, in many ways, the real challenges of raising children start when one leaves the hospital.

Like many American women, my wife, a teacher, did not have access to paid maternity leave. Hence, we had to make do with one income for a few months. Of course, this could not have been a more inconvenient time to lose a paycheck, because literally every day we received medical bills. Many of the bills misspelled someone’s name or got another fact wrong, which led to countless phone calls with providers and our insurer.

Diapers and other baby items, naturally, are also not cheap.

Once my semester ended in early May, my wife went back to work as I watched Lukas. This brought new challenges with it.

For one, as a professor, I am also not getting paid over the summer.

Moreover, while the Affordable Care Act provides added benefits and protections for breastfeeding, there are limitations. For one, not all breast pumps are covered, and insurance companies are getting stingier. This is, of course, ironic given that there is a whole other effort going on to encourage mothers to breastfeed more because it has been found so beneficial for mother and child.

Finding an appropriate place and time to pump breast milk at work, even with a decent pump and governmental protections, comes with a slew of challenges. Currently my wife is using every free minute she can find and locks her classroom. Finding the time and space when doing continuing education or field trips is, of course, a whole other story.

Going forward, we are rather lucky.

Thanks to the Affordable Care Act, well-child visits and preventive care like immunizations will be included in our insurance. Of course, should something serious happen, like a hospitalization, we will be on the hook again for potentially thousands of dollars.

My employer allows me to work from home during the fall semester so I can take care of Lukas at the same time. Of course, while I do not have to teach a class on campus, expectations about research and service will not diminish.

Yet soon, we will have to put Lukas into day care. We have been on several waiting lists since the moment we found out my wife was pregnant. Last time, I had to drive my son Nico 45 minutes one way to a day care we were comfortable with in Pennsylvania. Even if we are lucky to find a nice day care close by, fees will exceed in-state tuition at West Virginia University, my employer.

Putting our experience in perspective

Our experience is, of course, not unique.

America’s poorest members of society are somewhat shielded from medical costs. Medicaid generally does not require out-of-pocket contributions. For those on the Children’s Health Insurance Program and those with cost-sharing subsidies on the Affordable Care Act insurance marketplaces, out-of-pocket contributions are limited. In both cases, the high costs of giving birth are passed on to public sources and those of us with private insurance.

The real struggles of the poor begin as they seek to raise their children with limited resources and diminishing governmental support.

Yet the middle class more and more often finds itself squeezed between a rock and a hard place when it comes to health care. Premiums, deductibles and co-payments continue to increase while services and choices grow narrower every year.

With Republican efforts to undo much or all of the Affordable Care Act, even those of us with employer-sponsored insurance may lose many protections.

Many of us are simultaneously struggling to pay back our student loans, which already forces many to delay marriage, have kids, or buy a house.

For us, and many others, this also meant cutting back on virtually everything, including family vacations and replacing appliances. It also meant taking up every opportunity to add income for both of us by taking side jobs.

Any potential future pay raises are likely to be swallowed up by premium increases and co-payments as health care cost continue to grow unabated.

Too rich for government programs, yet too poor to avoid financial hardship

Given these struggles, it is perhaps not surprising that the frustrations of the middle class breed resentment toward publicly supported programs. Support for work requirements and more punitive and stigmatizing approaches to social programs are perhaps the understandable result.

Our current approaches to encourage and support parenthood are willfully inadequate. Health care, parental leave, day care, parental support, education. As a country, I think that we should strive to do better to support our families.

Simon Haeder

This article was originally published on