I'm A Mom Of 5. Here Are My Best Budgeting Hacks.

Will these solve your budget problems? Not completely! But they’re easy and really do help.

$312,202. That's the amount of money American families spend raising one child. Like many other American parents, I don't have just one kid — I actually have five. You do the math because it's too scary for me, and my brain might implode after that million-dollar mark.

With a pound of bacon pushing $10 and daycare costs outpacing typical salaries, it seems normal to worry and even panic at 3 a.m. (anyone?). Instead, let's keep calm and look to small, consistent budget hacks that add up over time. Here's what works for my family.

1. Garage Sales

I grew up going to garage sales with my own single mom. My childhood dresser, which I remember as fancy and beautiful, was a $10 steal at a neighbor's garage sale. In recent years, some of these bargains have moved onto Facebook Marketplace, where 90% of my kids' name-brand wardrobes have come from at around $1 per item. I've never felt bad having to throw out a .25-cent onesie covered in poop when I'm out in public because it wasn't expensive to begin with.

Other garage sale finds include a free set of four porch rockers with cushions, a set of five large art canvases (originally hundreds each), and, of course, many cups of lemonade for a quarter on hot, sunny garage sailing days. This budget-friendly hack also brings decades of memories of my mom and my kids checking out sales for baseball cards, funky jewelry, and everyday necessities.

Garage sales are also a fun way for kids to spend their allowance money — even if it's just a few dollars — on something they want, as more things are affordable secondhand.

2. Out-of-the-Box Leftovers

We have fridge cleanout meals multiple times per week. This might mean some pancakes revived in the air fryer, with a cut-up pork chop from a different dinner. Kids don't care what items go together! They even have fun with bizarre dinner combinations, especially if they get to pick. Smorgasbord buffets have saved us numerous times from what would have otherwise been expensive takeout nights.

"Limit takeout orders and cook at home, or at least pick up your takeout orders to avoid service fees and tips. We also always order takeout on our laptop so we can take advantage of cashback offers or coupons from sites like CouponCabin.com, which right now has offers for Grubhub, Doordash, and more," says Trae Bodge, Smart Shopping Expert at Truetrae.com. "My teen daughter always does this now when she places takeout orders when friends are over."

Bodge also says families save money by making their own staples, from ketchup to smoothies. "Consider making certain items instead of buying them pre-made. Things like hummus and granola can be expensive at the store but can be made at home fairly easily for a fraction of the cost. Another teachable moment: Invite your kids to help you in the kitchen and show them how much money you saved."

3. Start with Aldi

In a recent social media post from moms struggling with grocery budgets, most confirmed my go-to trick for slashing hundreds per month from grocery costs: good ole Aldi. While the store has gathered a cult-like following for niche, cheap items like the viral lemon-covered rompers and an always-sold-out holiday wine advent calendar, you really can't beat strawberries for $1.

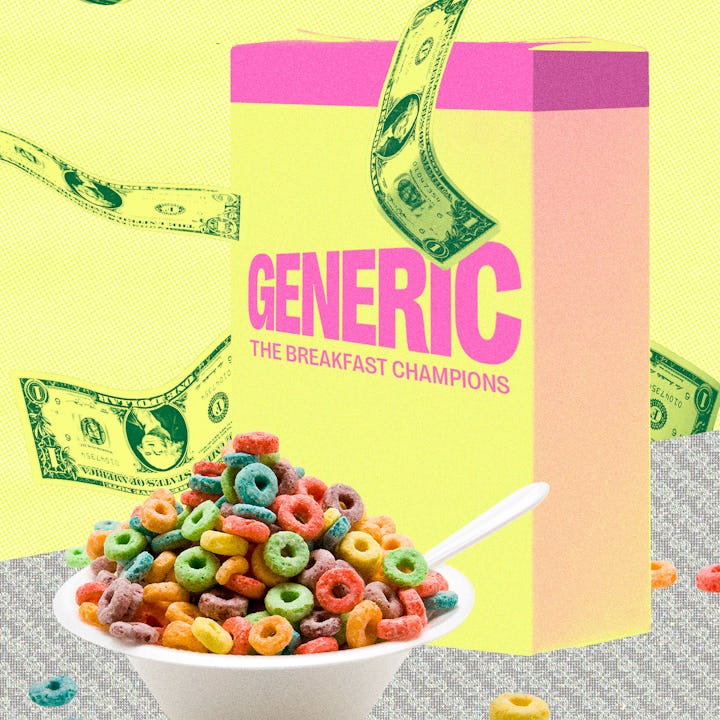

Even if you can't get all of your groceries from Aldi, or if it's too far away, you can stock up on staples and then prioritize spending more strategically at other stores for additional specialty items. If your kids are having trouble switching from specific brands to Aldi brands, simply start taking items out of their bags and store them in containers — they likely won't notice the difference between Fruit Loops and the off-brand version without the packaging around. Better yet, be honest and share why you're swapping, Bodge says.

"Switch from brand names to store brands. This is a way to avoid shrinkflation and save money. Store brands often have the same ingredients as the brand name (they are sometimes made in the same factories) and are usually much cheaper," she says. "Make this a teachable moment and explain that you are switching to save money so you can afford other things they enjoy. We have always kept our daughter Sadie, who is now almost 18, in the loop regarding money swaps like this, and she's now a skilled smart shopper."

4. Then Move to the Clearance Shelves

According to 2023 data collected from the U.S. Census Bureau Household Pulse Survey, HelpAdvisor found that an American family of four spends, on average, over $1,000 per month on groceries.

So, you can imagine how elated I was this week when I found big packs of Pullups for $2.30 at Kroger. With three of five kids still wearing them, this was a savings of at least $50 total. Digging through clearance shelves can lead to some fun finds and some splurgy items on a budget, like the NFL gear after our local team lost in the playoffs that came in handy the following season, or the stale Texas toast that made for awesome French toast sticks.

To maximize clearance savings, Bodge suggests trying an app like Flashfood. "Flashfood partners with grocers around the country and helps them sell through their merchandise that is nearing the best buy date or is in surplus by offering up to 50% off the retail price. You shop through the Flashfood app — which is something you can do with your kids! — and then pick up your order at the grocery," she says.

5. Switch to Anything Reusable

If each person in my house used a roll of paper towels each week, that would equal 28 rolls per month — or around $360 per year. A reusable pack of paper towels I bought for around $15 a few years back is still going strong. It's not that we never use paper towels; it's that now they aren't the first thing my kids know to reach for.

Other examples of reusable things that have helped quite a bit include stainless steel plastic plates instead of paper plates, reusable sandwich bags instead of Ziplocs, and even purchasing reusable furniture such as rugs that can fit a bathroom or playroom just the same. My favorite Esembly Day Bag doubles as a cloth diaper wet bag or a place for my kids to carry their wet swimsuits.

Even bigger purchases such as toys can shift from one-time events, like pricy water park tickets, to the cheaper at-home swap, like these beach bounce water parks my kids are obsessed with for the yard. For less than the price of taking our family to the water park one day, we can reuse this product for years to come.

But cloth towels, waterslides, and versatile rugs alone won't solve our budget concerns with this many kids (or any kids, really). What will is this mentality: the smaller swaps, made with intention and consistency hundreds of times each week.